Ever get that nagging feeling your meticulously cultivated cryptocurrency portfolio isn't quite performing as it should? You're diligently tracking market shifts, snatching up promising altcoins, and celebrating every green candle – yet your net gains feel… underwhelming. It’s a bit like training for a marathon with ankle weights you didn't know you were wearing, and the culprit might just be hiding in plain sight: your trusty multi-currency digital wallet.

Think of it: every transaction, every swap, every conversion across different blockchain networks involves a silent tax. These aren't always egregious, front-page fees; often, they’re subtle slippages in exchange rates, hidden charges for cross-chain transfers, or liquidity issues that nibble away at your potential earnings. Over time, these seemingly minor deductions don't just add up; they compound, stealthily eroding the very wealth you're striving to build in the volatile world of digital finance.

It’s a frustrating reality for many a savvy investor: believing you're optimizing returns only to discover your chosen asset custodian is effectively siphoning off a percentage of your hard-won gains. But what if there was a way to bypass these profit leaks? What if certain platforms were engineered specifically to maximize your holdings, offering transparent dealings and superior execution?

Prepare to scrutinize your current setup, because we’re about to unveil the elite roster of multi-asset wallets designed not just to hold your diverse crypto collection, but to actively protect and potentially amplify your financial future. If your go-to isn't on this exclusive list, it might be time for a serious upgrade – before your profits vanish into the ether.

In the exhilarating, often volatile, world of digital assets, every fraction of a percent counts. You've meticulously researched projects, timed your entries, and even braved the infamous bear markets. Yet, despite your strategic prowess, a silent saboteur might be eroding your hard-earned crypto gains without you even realizing it. We're talking about the very tool you rely on daily: your multi-currency wallet. For many, this indispensable utility, designed for convenience, inadvertently becomes a profit vampire, subtly siphoning value through an array of often-overlooked mechanisms.

The allure of a single interface managing a diverse portfolio across various blockchains is undeniable. It promises simplicity, accessibility, and a unified view of your financial frontier. However, this perceived efficiency often comes with a hidden cost, a financial drag that can significantly impede your wealth accumulation over time. Understanding these subtle drains is the first step toward reclaiming your full earning potential in the ever-evolving cryptocurrency landscape.

The Silent Profit Killer: Unmasking Hidden Wallet Costs

Beneath the sleek user interface of many multi-currency wallets lies a labyrinth of charges that can chip away at your capital. These aren't always glaring; sometimes they're insidious, only becoming apparent after numerous transactions or when comparing your actual returns against theoretical benchmarks. Transaction fees, while a necessary evil of blockchain networks, can become excessive when a wallet's internal routing isn't optimized, potentially leading to higher gas costs or network charges than necessary.

Beyond network charges, many platforms integrate their own proprietary exchange services. While convenient for swapping one digital asset for another, these internal exchanges often come with a hidden "spread." This spread is the difference between the buy and sell price, effectively a markup that accrues to the platform. Unlike transparent exchange fees, this can be difficult to quantify instantly, yet it significantly impacts the amount of crypto you receive from a trade, effectively diminishing your purchasing power.

Another culprit is slippage, especially prevalent during periods of high volatility or for larger trades. While not a direct fee from the wallet provider, a poorly integrated or executed internal swap can lead to a significant difference between the expected price of a trade and the price at which it actually executes. This discrepancy, often exacerbated by thin liquidity or inefficient routing within the wallet's integrated services, represents a direct loss in value for the user. Cumulatively, these small slippages can add up to substantial missed opportunities or outright losses over an active trading period.

Beyond the Basics: Why "Convenience" Comes with a Price Tag

The pursuit of convenience often blinds users to the underlying financial implications. Many individuals opt for a multi-asset solution for its perceived ease of use, prioritizing a single dashboard over the meticulous optimization of transaction costs. This trade-off, while seemingly minor on a per-transaction basis, can become a significant drag on a portfolio's performance, especially for those who frequently interact with multiple digital currencies or engage in more sophisticated DeFi activities.

Furthermore, the integrated exchange functions within many wallets frequently offer limited options for liquidity sourcing, often relying on a single or a few preferred providers. This lack of competition can translate into less favorable exchange rates compared to what might be found on dedicated, high-volume centralized or decentralized exchanges. Users, perhaps unaware or simply too busy to comparison shop, accept these rates, unknowingly leaving potential profits on the table with every conversion.

Beyond mere swaps, some multi-asset platforms fall short in their support for advanced investment strategies. Features like integrated staking, direct access to yield farming protocols, or seamless interaction with lending platforms might be absent or poorly implemented. For savvy investors looking to maximize returns beyond simply holding assets, a wallet that lacks these robust functionalities forces them to move funds to other platforms, incurring additional transfer fees and exposing them to more complex operational risks.

The Perils of Poor Interoperability and Limited Asset Support

A "multi-currency" label can sometimes be misleading. While many wallets claim to support a broad spectrum of digital assets, the depth and quality of this support vary wildly. Some merely offer basic storage for a token on its native chain, without providing seamless access to its ecosystem or decentralized applications (DApps). This superficial support can lead to clunky user experiences, requiring users to export private keys or import seed phrases into other interfaces, which carries inherent security risks and adds considerable friction.

Moreover, the pace at which new tokens, innovative blockchain networks, or critical protocol upgrades are supported can significantly impact a user's ability to participate in emerging opportunities. A wallet that lags in integrating new chains or popular tokens might force investors to spread their assets across numerous different wallets. This fragmentation complicates portfolio management, increases the likelihood of errors, and makes comprehensive tracking a daunting task, indirectly impacting overall investment strategy.

Beyond functionality, security remains paramount. Wallets that offer broad asset support but lack a rigorous audit history or transparent security protocols present an elevated risk profile. While convenience is appealing, a compromise on the foundational security measures of a digital asset custodian is an unacceptable peril. Users must scrutinize not just what a wallet *can* do, but how securely and reliably it performs its functions, especially when dealing with a multitude of assets.

Spotting the Saboteur: Red Flags Your Wallet Might Be Underperforming

Discerning whether your current digital asset repository is a silent saboteur requires a keen eye and a bit of detective work. One of the most telling indicators is consistently high spreads on internal swaps. If the difference between the buy and sell price for a given asset within your wallet's exchange function seems noticeably wider than what you observe on major external exchanges, you are likely paying a premium for convenience. These seemingly small discrepancies can accumulate rapidly, eating into your potential gains.

Another prominent red flag is an opaque or confusing fee structure. If you find yourself struggling to understand exactly what charges apply to various transactions—be it sending assets, swapping them, or withdrawing to an external address—then the platform may be intentionally obscuring its true cost. Transparent platforms make their fees explicit, often providing detailed breakdowns before you confirm any action, empowering you to make informed financial decisions rather than facing surprises post-transaction.

Limited withdrawal options, coupled with excessively high withdrawal minimums or fees, are also cause for concern. Some wallets, particularly those acting more like custodial exchanges, might impose stringent rules on how and when you can move your assets off their platform. This can restrict your liquidity and force you into unfavorable positions if you need to quickly transfer funds or take advantage of an arbitrage opportunity elsewhere. Slow transaction processing on popular networks, especially when other users report faster confirmations, could also indicate inefficient routing or overloaded infrastructure, both of which can lead to missed opportunities and increased stress.

The Elite List: Wallets That Champion Your Crypto Profits

Fortunately, not all multi-currency solutions are created equal. A select cadre of digital asset managers are engineered with the user's financial well-being at their core, transforming from mere storage solutions into powerful tools that enhance, rather than erode, your crypto gains. These superior options are characterized by a relentless focus on efficiency, transparency, and robust functionality, ensuring that your portfolio isn't just secure, but also optimally positioned for growth.

Firstly, the top-tier wallets champion transparent and remarkably competitive fee structures. They offer clear breakdowns of all associated costs—network fees, service charges, and any potential spreads—before you commit to a transaction. Many leverage advanced routing algorithms to find the most cost-effective path for network transactions, minimizing gas expenditure, particularly during peak congestion. Some even provide options for users to adjust network fees manually, granting greater control over transaction speed and cost.

Secondly, these outstanding digital wallets integrate highly optimized exchange functionalities. Instead of relying on a single, potentially less competitive liquidity provider, they often aggregate liquidity from multiple sources, ensuring you consistently receive the best real-time exchange rates with minimal slippage. This aggregation means that when you swap assets, the integrated service intelligently searches for the most favorable market conditions, maximizing the amount of crypto you receive and preserving your capital effectively.

Thirdly, superior wallets boast genuinely robust asset support and unparalleled interoperability. They don't just list tokens; they deeply integrate with their native blockchains, offering seamless interaction with a vast ecosystem of decentralized applications (DApps) and protocols. This means you can stake, lend, or participate in governance directly from your wallet without needing to move assets or compromise security. They are quick to adopt new chains and trending tokens, keeping you at the forefront of digital asset innovation without compromising on security or user experience.

Moreover, these elite platforms often come packed with advanced features designed specifically for profit generation and portfolio enhancement. This might include native staking options for various proof-of-stake assets, direct portals to reputable yield farming opportunities, or integrated lending protocols that allow you to put your dormant assets to work. Some even offer sophisticated portfolio tracking tools, real-time analytics, and alerts, providing you with the insights needed to make informed, timely decisions and capitalize on market movements.

Finally, and perhaps most crucially, the best multi-asset wallets prioritize superior security and user control. Many champion non-custodial principles, meaning you retain full ownership of your private keys, making you the sole guardian of your digital wealth. They implement robust security measures such as multi-factor authentication, biometric logins, and regular security audits by independent third parties. These features, combined with intuitive interfaces and responsive customer support, create a secure, efficient, and empowering environment for managing your diverse cryptocurrency holdings.

Navigating the Digital Asset Landscape: A Strategy for Success

Choosing the right multi-currency wallet is not merely about finding a place to store your digital assets; it's about selecting a strategic partner that aligns with your financial goals and actively contributes to the growth of your crypto portfolio. The digital asset landscape is dynamic, and what works today might not be optimal tomorrow. Therefore, continuous due diligence and a proactive approach to wallet selection are paramount for sustained success.

Before committing to any platform, thoroughly evaluate your personal crypto strategy. Are you primarily a long-term holder, a frequent trader, an ardent DeFi enthusiast, or a blend of all three? Your specific needs will dictate the features that matter most. A wallet optimized for staking might differ from one built for lightning-fast, low-cost swaps. Understanding your own habits and objectives will help you prioritize the crucial functionalities and cost efficiencies required from your chosen digital asset management tool.

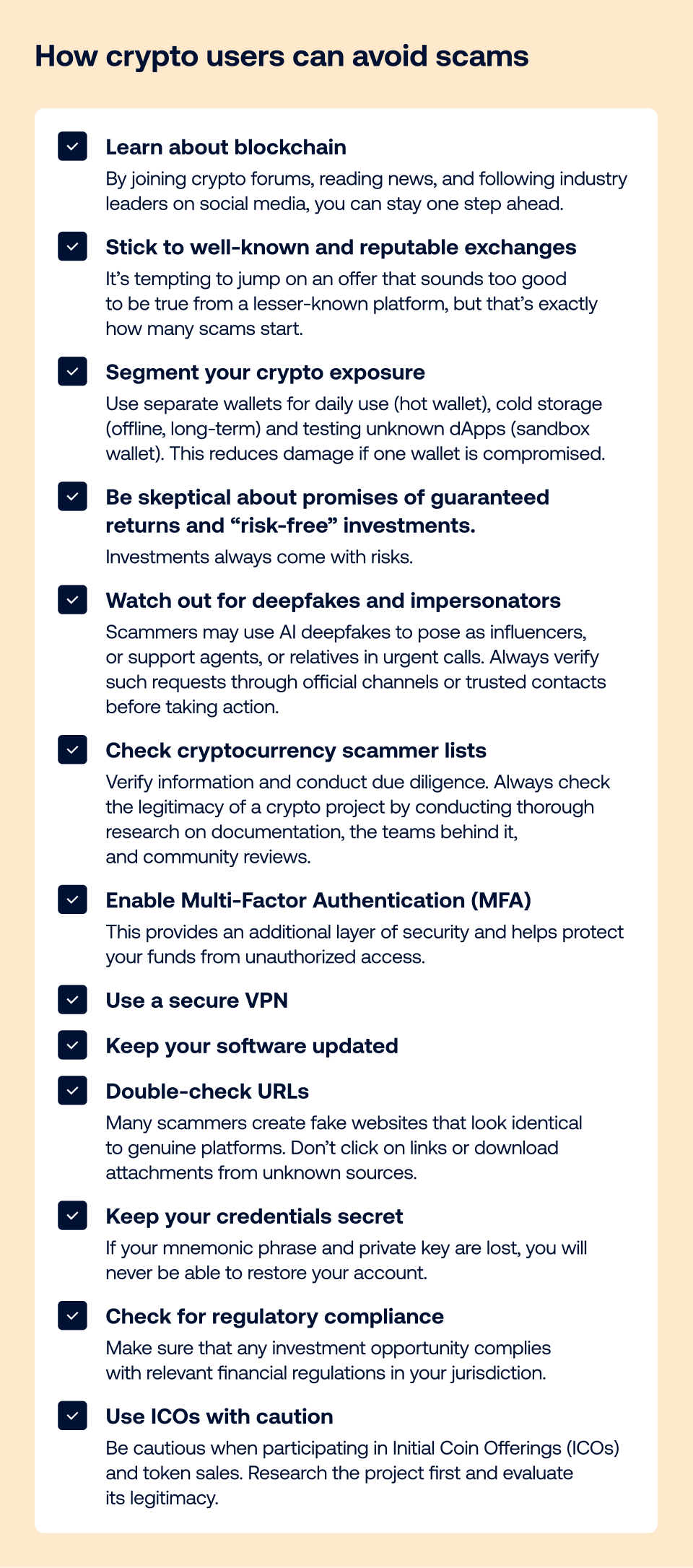

It's also a prudent strategy to diversify your wallet usage where appropriate. For instance, separating significant long-term holdings into cold storage (hardware wallets) while utilizing a hot wallet for active trading and DeFi interactions can provide an optimal balance of security and accessibility. This segmented approach mitigates risk and ensures that your most substantial investments are safeguarded from the everyday vulnerabilities associated with online interactions.

Regularly reviewing your wallet's performance against market offerings is not just good practice; it’s essential. The cryptocurrency ecosystem evolves at breakneck speed, with new, more efficient, and feature-rich solutions emerging constantly. What was once the pinnacle of multi-asset management might eventually become outdated or less cost-effective. Staying informed about the latest innovations and being willing to adapt your toolkit ensures that your multi-currency wallet remains an asset, not a silent saboteur, in your quest for crypto profits.

So, you’ve navigated the treacherous waters of crypto investing, dodged FOMO-driven pumps, and perhaps even survived a few notorious dumps. You’ve earned your stripes, and now it’s time to ensure your chosen digital asset custodian isn't quietly picking your pockets. Your multi-currency wallet isn't just a digital vault; it’s a strategic partner, a co-pilot in your quest for financial sovereignty in this wild, wonderful, and ever-shifting decentralized frontier.

Before pledging allegiance to any one platform, take a moment for some serious self-reflection. Are you the hodler, content to watch your digital seeds sprout over seasons? Or a nimble day-trader, constantly chasing the next micro-gain? Perhaps a DeFi wizard, weaving through liquidity pools and yield farms? Your unique style dictates the crucial functionalities and cost efficiencies your crypto portfolio manager truly needs.

A savvy strategist never puts all their eggs in one blockchain basket. Consider a diversified approach: stash your significant long-term holdings in the digital Fort Knox of cold storage – a hardware wallet, perhaps – while reserving a more agile hot wallet for your daily trading shenanigans and daring DeFi expeditions. This clever segmentation isn't just about risk mitigation; it's about optimizing both security and accessibility, ensuring your most prized digital possessions are truly out of arm's reach from online vulnerabilities.

And finally, dear crypto connoisseur, don’t ever set it and forget it. The digital asset cosmos moves at warp speed; today's cutting-edge solution can be tomorrow's costly relic. Regularly pit your current wallet's performance against the latest market offerings, because staying ahead means staying profitable. Keep your toolkit sharp and your eyes peeled, lest your chosen custodian morphs from a trusted ally into the very "silent saboteur" you've worked so hard to outmaneuver.

Image source: Sumsub

Post a Comment