In the high-stakes arena of digital currencies, few debates spark more fervent arguments than the fundamental mechanisms underpinning their very existence. It’s a bit like choosing between a grizzled, old-school champion with a proven track record and a sleek, agile newcomer promising a greener, more efficient future. We're talking, of course, about Proof-of-Work (PoW) versus Proof-of-Stake (PoS) – the two titans vying for dominance in the world of blockchain validation. The question isn't just academic; it profoundly shapes the trajectory of decentralized finance and, by extension, your own crypto portfolio. So, which steed deserves your allegiance?

For years, the pioneering Proof-of-Work system, famously championed by Bitcoin, served as the unchallenged bedrock of cryptocurrency security. Its ingenious design harnessed computational power to secure transactions, forging an immutable ledger through the sheer force of distributed effort. Yet, as the blockchain landscape matured and environmental concerns grew louder, a challenger emerged: Proof-of-Stake, proposing a dramatically different approach to achieving consensus, trading brute force for economic commitment.

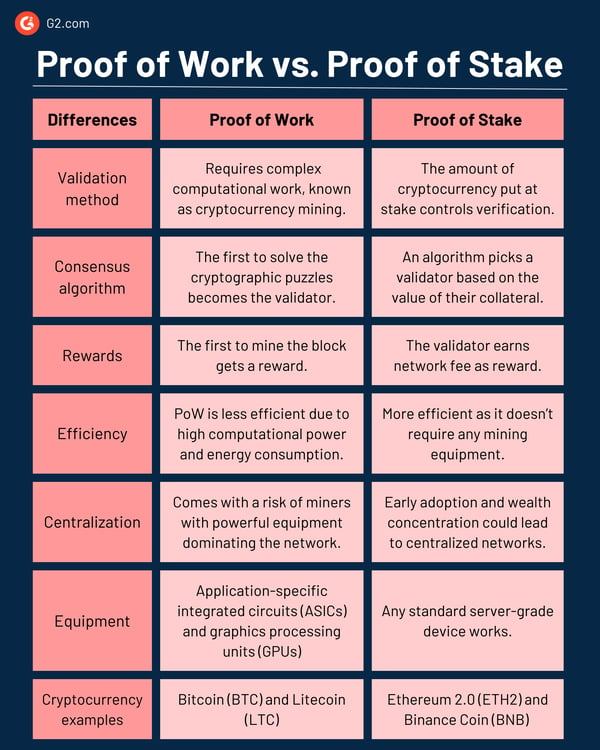

This isn't merely a technical squabble between computer science professors; it’s a philosophical clash with real-world implications, affecting everything from energy consumption and network decentralization to transaction speeds and overall system robustness. One relies on miners burning through electricity to solve complex puzzles, while the other hinges on validators staking their valuable digital assets as collateral for good behavior. Each method presents its own unique set of advantages and vulnerabilities, often drawing battle lines across the crypto community.

Navigating this complex terrain requires more than just a passing understanding of buzzwords; it demands a deep dive into the engineering, economics, and ethos of each system. We're about to dissect these powerful consensus models, exploring what makes them tick, where they excel, and what inherent trade-offs each brings to the table. By the end of this exploration, you’ll be far better equipped to understand the ongoing evolution of blockchain technology and, perhaps, even pick your champion in this monumental race.

In the vibrant, often tumultuous realm of decentralized finance, two titans of consensus mechanisms have long vied for supremacy: Proof-of-Stake (PoS) and Proof-of-Work (PoW). It’s more than just technical jargon; it’s a philosophical fork in the road for how digital currencies and applications secure their networks, validate transactions, and ultimately, evolve. The debate isn't merely academic; it shapes the very infrastructure of the future internet and digital economy, prompting a crucial question: are you backing the right horse in this exhilarating race?

The Herculean Effort: Understanding Proof-of-Work

Imagine a global competition where participants tirelessly solve complex mathematical puzzles. The first one to crack the code earns the right to add a new block of transactions to a public ledger, receiving a handsome reward in the process. This, in essence, is the elegant yet resource-heavy dance of Proof-of-Work, the pioneering consensus protocol that underpins Bitcoin and, until recently, Ethereum.

How PoW Flexes Its Digital Muscles

At its core, a PoW network relies on "miners" – specialized computers or vast arrays of them – that expend significant computational energy to discover a nonce, a single numerical value that, when combined with the block's data and hashed, produces a result below a target threshold. This cryptographic puzzle is deliberately challenging to solve but simple for any other network participant to verify. The immense effort required deters malicious actors; altering a single block would necessitate re-solving not only that puzzle but all subsequent ones, an astronomically expensive and practically impossible feat.

Each successful resolution not only validates transactions but also effectively secures the entire history of the distributed ledger. This energy expenditure isn't a bug; it's a feature, designed to impart a tangible, real-world cost to network participation, making it incredibly resilient against attack. The sheer computational might dedicated to networks like Bitcoin stands as a testament to this robust security model.

The Enduring Strengths of Proof-of-Work

The primary allure of PoW lies in its battle-tested security and unparalleled decentralization. Bitcoin, the progenitor of cryptocurrencies, has operated flawlessly for over a decade, with its ledger remaining immutable and incorruptible. The mechanism ensures that no single entity can dictate the network's terms; myriad independent miners across the globe contribute their processing power, fostering a genuinely distributed control. This widespread participation makes it incredibly resistant to censorship and external interference, embodying the core ethos of self-sovereignty that underpins the cryptocurrency movement.

Moreover, the transparency of the mining process means anyone can become a validator, provided they have the hardware and electricity. This open-access philosophy has cultivated a diverse ecosystem of participants, strengthening the network’s integrity over time. It’s a verifiable, trust-minimized system where the energy expended serves as an irrefutable proof of work done, cementing its reputation as a digital bedrock.

The Heavy Price of Power: PoW's Achilles' Heel

Yet, PoW's formidable strengths come with equally formidable drawbacks, primarily its voracious appetite for electrical energy. The global energy consumption of networks like Bitcoin rivals that of entire medium-sized nations, sparking intense debate about environmental sustainability. Critics argue that such an energy-intensive operation is simply unsustainable in a world grappling with climate change, casting a long shadow over its long-term viability.

Beyond the environmental impact, the escalating cost of specialized mining hardware (ASICs) has led to a degree of centralization. While the network technically remains decentralized, the economic reality is that large mining pools, often operating in regions with cheap electricity, dominate a significant portion of the network's processing power. This concentration of hash power, while not a direct threat to immutability in healthy networks, does raise eyebrows regarding the purity of its distributed control and accessibility for the average individual.

The Economic Calculus: Unpacking Proof-of-Stake

Enter Proof-of-Stake, a more recent contender that seeks to address PoW’s limitations by fundamentally altering the cost of participation. Instead of expending computational resources, PoS networks rely on economic capital as collateral. It’s a shift from "might makes right" (computational power) to "skin in the game" (financial stake).

Staking Your Claim: How PoS Rewrites the Rules

In a PoS system, "validators" don't solve puzzles; instead, they "stake" a certain amount of the network's native cryptocurrency as collateral. Think of it as putting up a security deposit. These validators are then randomly selected to propose and validate new blocks. If they act honestly, they earn transaction fees and newly minted tokens as rewards. If they attempt to defraud the network or act maliciously, they risk having a portion of their staked capital "slashed" – effectively confiscated by the network – providing a powerful economic disincentive for bad behavior.

The capital-intensive nature of this model replaces the energy-intensive computations of PoW. It’s a system built on economic incentives and deterrents, where maintaining network integrity aligns directly with a validator's financial self-interest. Ethereum's much-anticipated "Merge" migration from PoW to PoS stands as the most significant endorsement of this paradigm shift, signaling a potential future for many other blockchain initiatives.

The Allure of Efficiency: PoS's Key Advantages

The most celebrated benefit of PoS is its drastically reduced energy consumption. By eliminating the need for vast mining farms, PoS networks are orders of magnitude more energy-efficient, often consuming less electricity than a small town rather than a small country. This environmentally friendly footprint makes it a far more palatable option for those concerned about climate impact and offers a compelling narrative for mainstream adoption.

Furthermore, PoS typically boasts enhanced scalability potential. Without the latency constraints imposed by mining's iterative puzzle-solving, PoS chains can often process more transactions per second (TPS) and finalize blocks faster. This improved transaction throughput is crucial for supporting large-scale decentralized applications and handling mass adoption. The barrier to entry for participation is also lowered; while a substantial stake may be required, it's generally more accessible than purchasing and maintaining specialized, expensive mining hardware.

Navigating the New Frontier: PoS's Intrinsic Challenges

However, PoS isn't without its own set of unique challenges. A primary concern revolves around the potential for wealth centralization. If validators with larger stakes have a higher probability of being chosen to validate blocks and earn rewards, the rich could theoretically get richer, leading to a concentration of power among a few large holders. While mechanisms like random selection and delegating stake to smaller validators aim to mitigate this, it remains a persistent point of contention regarding true decentralization.

Another historical critique, though largely addressed in modern PoS implementations, is the "nothing at stake" problem. In early PoS designs, validators had no strong incentive to commit to a single chain if a fork occurred, potentially validating on both chains without penalty. Modern PoS protocols, like Ethereum's slashing mechanism, penalize validators for equivocation, ensuring they have genuine economic skin in the game. Nevertheless, the robustness of PoS security in extreme conditions, particularly against a large-scale coordinated attack, is still an area of ongoing research and development compared to PoW's proven track record.

Head-to-Head: A Critical Comparison of Consensus Giants

Comparing these two monumental approaches isn't about declaring an outright victor but understanding their fundamental trade-offs. Each mechanism excels in certain areas while presenting distinct vulnerabilities.

The Energy Footprint: A Stark Contrast

Here, PoS unequivocally takes the crown for efficiency. The difference in energy consumption between the two is staggering. PoW's reliance on brute-force computation demands immense electrical power, while PoS achieves consensus through cryptographic signatures and economic guarantees, consuming negligible energy in comparison. For any entity prioritizing environmental responsibility, the choice leans heavily towards staking protocols.

Security Paradigms: Hashpower vs. Financial Skin in the Game

Both systems aim for robust network integrity, but they achieve it through different means. PoW's security is derived from the sheer computational cost to overwhelm the network (a 51% attack), making it incredibly difficult and expensive. PoS, on the other hand, relies on the economic cost of acquiring and staking enough tokens to control the network, coupled with the threat of slashing. While both offer strong deterrents, PoW’s security model has been battle-hardened for longer, while PoS is still proving its long-term resilience against sophisticated financial attacks.

Decentralization: A Perennial Debate

The ideal of decentralized control is central to both. PoW distributes power through open mining participation, but hardware and energy costs can lead to pool concentration. PoS aims for distributed control through token ownership, but the risk of wealth concentration leading to a few powerful validators is a valid concern. The effectiveness of decentralization in both systems ultimately hinges on the distribution of the underlying resource—computational power for PoW, and staked capital for PoS.

Scalability and Accessibility: Opening the Gates

PoS generally offers a more direct path to scalability, as its design inherently allows for higher transaction throughput and faster block finality, which are critical for high-volume applications. The lower barrier to entry in terms of equipment, allowing anyone with sufficient tokens to participate as a validator (or delegate their stake), also contributes to its appeal. PoW networks often face inherent throughput limitations due to the nature of their puzzle-solving mechanics, although layer-2 solutions are emerging to address this.

The Evolving Landscape: Which Mechanism Holds the Reins?

Deciding which consensus mechanism is "better" is akin to choosing the right tool for a specific job; there's no universal answer. Bitcoin’s unwavering commitment to Proof-of-Work highlights its prioritization of maximal security and proven immutability, even at a high environmental cost. Ethereum's bold pivot to Proof-of-Stake, conversely, signals a future where efficiency, scalability, and environmental friendliness are paramount for a smart contract platform destined for global applications.

The "right horse" depends entirely on the specific goals and values of the network and its community. For digital gold and censorship resistance, PoW has a compelling track record. For high-throughput applications, environmental consciousness, and a broader range of decentralized services, PoS offers an attractive, forward-looking alternative. The evolution of blockchain technology isn't a zero-sum game; hybrid models and innovative new protocols continue to emerge, aiming to capture the best attributes of both worlds. The landscape is dynamic, and the race for cryptographic consensus is far from over, promising continued innovation and fierce competition.

So, the dust has settled, the numbers have crunched, and the philosophical sparring has ceased. Have you picked your champion in the great blockchain battle between Proof-of-Work and Proof-of-Stake? If you're still pondering, rest assured, you're in good company – because the ultimate answer is far less about a knockout punch and much more about context.

For those prioritizing an ironclad, battle-hardened digital fort, the energy-intensive yet supremely secure Proof-of-Work mechanism, championed by the venerable Bitcoin, remains the undisputed king. It’s the original digital gold standard, sacrificing power efficiency for an unparalleled track record of network resilience and censorship resistance.

Conversely, if the future of decentralized applications demands a greener, faster, and more scalable engine, Proof-of-Stake, as embodied by the ambitious Ethereum, presents a compelling vision. This economically-driven approach significantly slashes power consumption, paving the way for high-throughput, environmentally conscious blockchain solutions.

Ultimately, the 'right' consensus model isn't etched in stone; it’s a fluid choice dictated by a network’s specific aspirations and its community's core tenets. The ongoing evolution in blockchain technology isn’t a zero-sum game, either. We’re already witnessing the emergence of ingenious hybrid designs and novel protocols, all striving to synthesize the finest attributes of both foundational systems.

As the distributed ledger space relentlessly innovates, the quest for the ultimate cryptographic consensus mechanism remains fiercely contested and profoundly dynamic. So, keep your eyes on the digital horizon, because the thrilling race between these titans of trust, and their exciting descendants, is far from over.

Image source: G2 Learning Hub

Post a Comment